Innovative Energy Technologies in Austria - Market Development 2017

Bibliographic Data

Market Survey 4/2018Peter Biermayr, Christa Dißauer, Manuela Eberl, et al.

Publisher: BMVIT

German, 257 pages

Content Description

The documentation and market research in the field of technologies for the use of renewable energy sources creates a basis for the planning and decision making in politics, economy, research and development. The aim of this market study "Innovative energy technologies in Austria – market development 2017" is to lay a foundation in the following fields: biomass, photovoltaics, solar thermal collectors, heat pumps and wind power.

Methods used are: questionnaires handed out to manufacturers, trading firms and installation companies as well as questionnaires for funding providers at the national and local governments. Furthermore information is gathered with a survey of literature, the evaluation of available statistics and internet research. The obtained data is displayed in time series to provide the starting point for deeper analysis and strategical considerations.

First the market development is illustrated by production numbers or installed capacities and then the energy gain is calculated taking into account the life cycle of the machinery. The necessary support energy for the main and auxiliary machinery is discussed and savings in gross and net of greenhouse gas emissions are calculated. The graphically displayed turnovers and the job creating effects eventually show the impact of the various technologies in Austria. Results are shown in alphabetical order of technologies.

Introduction

The market development of renewable energy technologies in 2017 was influenced by hindering and supporting factors. Persistently low fossil fuel prices, low refurbishment rates, cautious signals from energy policy instruments and competition among renewable energy technologies themselves inhibited diffusion while overall economic growth, increased private spending, and weather contributed to market diffusion.

Against this background, an increase in the use of biomass fuels, an increase in sales of biomass boilers and heat pumps as well as an increase in the new installation of photovoltaic systems can be observed for the year 2017. At the same time a decline in the area of biomass furnaces, solar thermal energy and wind power happened.

The 2017 market figures thus show significantly more areas in comparison to 2016 in which growth was noticeable. However, this is taking place at low levels in many places and is therefore not sufficient to meet the medium to long-term national energy and climate goals. For this reason, more efforts are needed to trigger the growth required for an real energy transition. In this context, both short-term and long-term strategic and energy-policy, environmental and research policy instruments must be used which together with the efforts of the economy will lead to the goal.

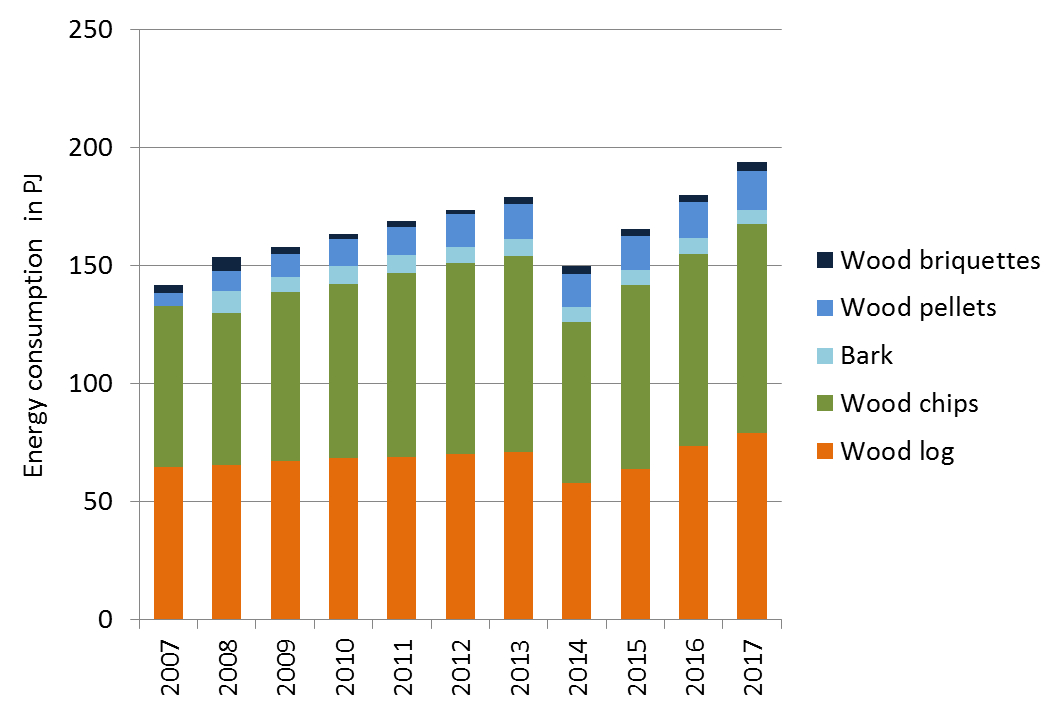

Solid biomass - fuels

The energetic utilisation of solid biomass has a long tradition in Austria and is still a very important factor within the renewable energy sector. The consumption of final energy from solid biofuels increased from 142 PJ in 2007 to 179 PJ in 2013. In 2014 the consumption of solid biofuels decreased to 150 PJ due to relatively high average temperatures see Figure 1.

In the following years the consumption of solid biofuels increased again, in 2017 up to 193.6 PJ. The consumption of wood chips has been increasing since the beginning of the 1980s. In 2017 the wood chips consumption was 88.8 PJ and thus exceeds the consumption of wood logs with 78.7 PJ. The very well documented wood pellet market developed with an annual growth rate between 30 and 40 % until 2006.

This development was then stopped 2006 due to a supply shortage which resulted in a substantive price rise. But meanwhile the market recovered and the production capacity of 32 Austria pellet manufacturers has been extended to 1.61 million tons a year. In 2017 the national pellet consumption increased by 6.7 % to 16.3 PJ (960,000 t) compared to the previous year. The Austrian pellet production was around 1.2 Mio t pellets in 2017.

Fuels from solid biomass contributed to a CO2 reduction of about 10.18 million tons in 2017. The whole sector of solid biofuels made a total turnover of 1,606 billion Euros thus creating 18,967 jobs.

The success of bioenergy highly depends on the availability of suitable biomasses in sufficient volumes and at competitive prices. Therefore, the upgrading of residues, co-products and waste to solid biofuels will be important in the upcoming years since it is seen as high potential for the future extension of the biomass base.

In addition to the traditional use of biomass in the heating sector, the importance of bioenergy as part of a sustainable energy system in combination with other renewables is increasing: biomass fuels are weather-independent energy suppliers. In this context the co-production of electricity and/or material products such as biochar is of great interest in order to ensure the most efficient use of resources.

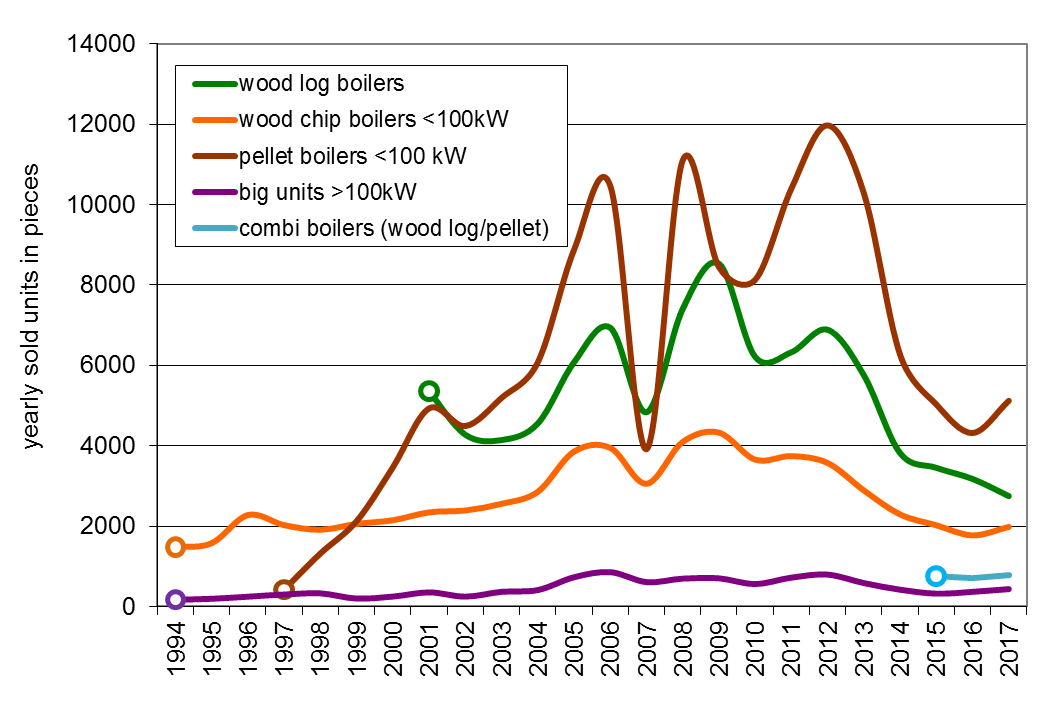

Solid biomass - boilers and stoves

The market for biomass boilers has steadily increased in Austria from 2000 until 2006 with a constantly high market growth. A market break of more than 60 % occurred 2007 for all types of biomass boilers due to low prices for heating oil and the mentioned supply shortage of pellets see Figure 2. The installation of additional pellet production capacities has eliminated the risk of shortage.

In 2009 the sales figures declined again essentially by 24 % due to lower oil prices caused by the global finance and economic crisis. In the years 2011 and 2012 the sales of pellet boilers increased strongly facilitated by rather high heating oil prices and moderate pellet prices. In 2012 the market for pellet boilers was growing again with 15 % increase of sales.

In 2013 the biomass boiler sales declined due to higher biofuel prices and the effect of investments in advance in the years after the economic crisis. This trend also continued in the years 2014 to 2016 due to low oil prices and warm weather.

In contrast, an increase of the number of sales of all types of biomass boilers, except for wood log boilers (-13.4 %), can be observed in 2017. In 2017, the sales figures of pellet boilers increased by 19.3 %, the sales of wood log-pellet combi-boilers increased by 11.4 % and the sale of small-scale (<100 kW) wood chip boilers increased by 11.8 %.

In 2017 5,224 pellet boilers, 2,750 wood log boilers, 775 wood log-pellet combi-boilers and 2,312 wood chip boilers were sold on the Austrian market, all boilers concerning the whole range of power. Furthermore at least 1,672 pellet stoves, 6,677 cooking stoves and 7,235 wood log stoves were sold.

Austrian biomass boiler manufactures typically export approximately 80 % of their production. The biomass boiler and stoves sector obtained a turnover of 863 million Euro in 2017. This resulted in a total number of 3,601 jobs in Austria.

Research efforts are currently and in next future focused on the extension of the power range, further reduction of emissions and the use of biomass as an energy carrier in industrial and commercial processes with high heat demand. In addition to the technological quality, a further reduction of capital costs is decisive for achieving success in international markets.

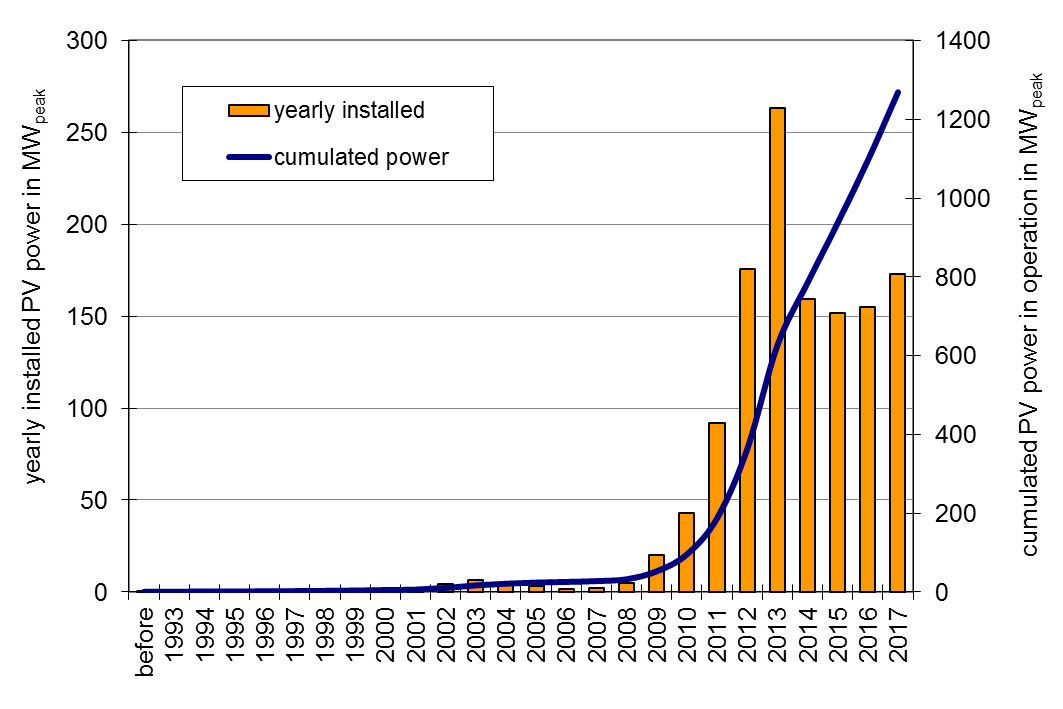

Photovoltaic

For the first time after the early phase of innovators and stand-alone systems the Austrian photovoltaic market in 2003 experienced an upsurge as the green electricity bill (Ökostromgesetz) was passed before collapsing again due to the capping of feed-in tariffs in 2004. After the absolute highest market diffusion of photovoltaic systems in Austria in 2013 due to an extra funding process, the PV market has stabilized from 2014 to 2016, see Figure 3.

In 2017, for the first time since three years, a moderate increase in newly installed PV in Austria was recorded: As a result, grid-connected plants with a total capacity of 172,479 kWpeak and stand-alone systems with a total capacity of approximately 476 kWpeak were installed in 2017.

Hence, in 2017 the total amount of installed PV capacity in Austria increased to 172,955 kWpeak, which led to a cumulated total, installed capacity of 1.269 MWpeak. As a consequence, the sum of produced electricity by PV plants in operation amounted to at least 1,296 GWh in 2017 and lead to a reduction in CO2 - emissions by 377,392 tons.

The Austrian photovoltaic industry is covering the production of PV modules and inverters as well as other PV components and devices. Furthermore, there is a high density of planning and installation companies for PV systems as well as specialized institutions and universities, which play an important role in international photovoltaic research & development (R&D).

Within those economic sectors 2,813 persons are employed full-time, which raises solar technology to an overall substantial market. The average system price of a grid-connected 5 kWpeak photovoltaic plant in Austria decreased from 1,645 Euro/kWpeak in 2016 to 1,621 Euro/kWpeak in 2017, i.e. a reduction of 1.47 %.

Especially the development of building integrated photovoltaic elements is of high importance for Austria. High added value seems to be achievable in this market branch. Furthermore, due to the increased deployment of PV-systems, the question of PV grid integration becomes an important national driver for Smart Grids.

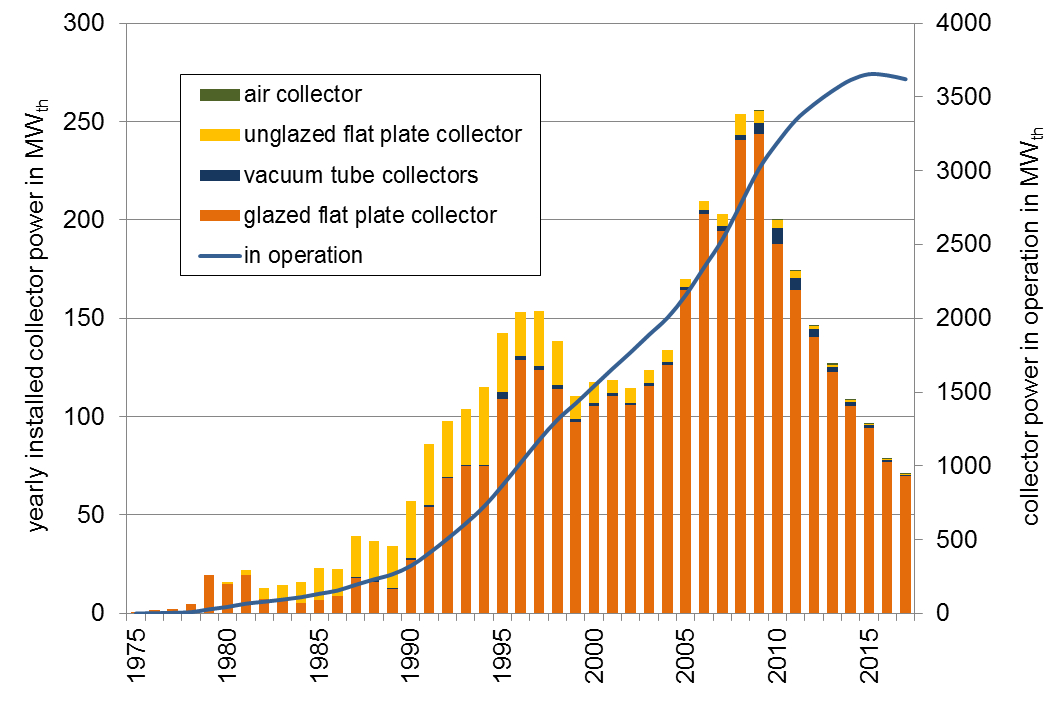

Solar thermal collectors

In Austria solar thermal systems for hot water preparation and swimming pool heating faced a first boom period already in the 1980ies. At the beginning of the 1990ies it was possible to develop a considerable market in the field of solar combi systems for hot water and space heating.

In the period between the year 2002 and 2009 the solar thermal market grew significantly and reached the peak in 2009 due to rising oil prices but also due to new applications in the multifamily house sector, the tourism sector as well as with new applications in solar assisted district heating and industrial process heat.

After this phase of massive growths the sector is facing a declining market in the eight year in a row. In the beginning of this development this was caused by the effects of economic and financial crisis but is now mainly influenced by the growing competition with photovoltaic systems, the increased use of heat pumps as well as the still low prices of fossil fuels.

By the end of the year 2017 approx. 5.2 million m2 of solar thermal collectors were in operation. This corresponds to an installed thermal capacity of 3.6 GWth. The solar yield of the solar thermal systems in operation is equal to 2,121 GWhth. The avoided CO2-emissions are 408,704 tons.

In 2017 a total of 101,780 m2 solar thermal collectors were installed, which corresponds to an installed thermal capacity of 71.1 MWth as Figure 4 shows. The development of the solar thermal collector market in Austria was characterized by a decrease of the sales figures of 9.1 % in 2017. The export rate of solar thermal collectors rose up to 84 %.

The turnover of the Austrian solar thermal industry was estimated with 178 million Euros for the year 2017. Therefore approx. 1,500 full time jobs can be numbered in the solar thermal business.

Heat pumps

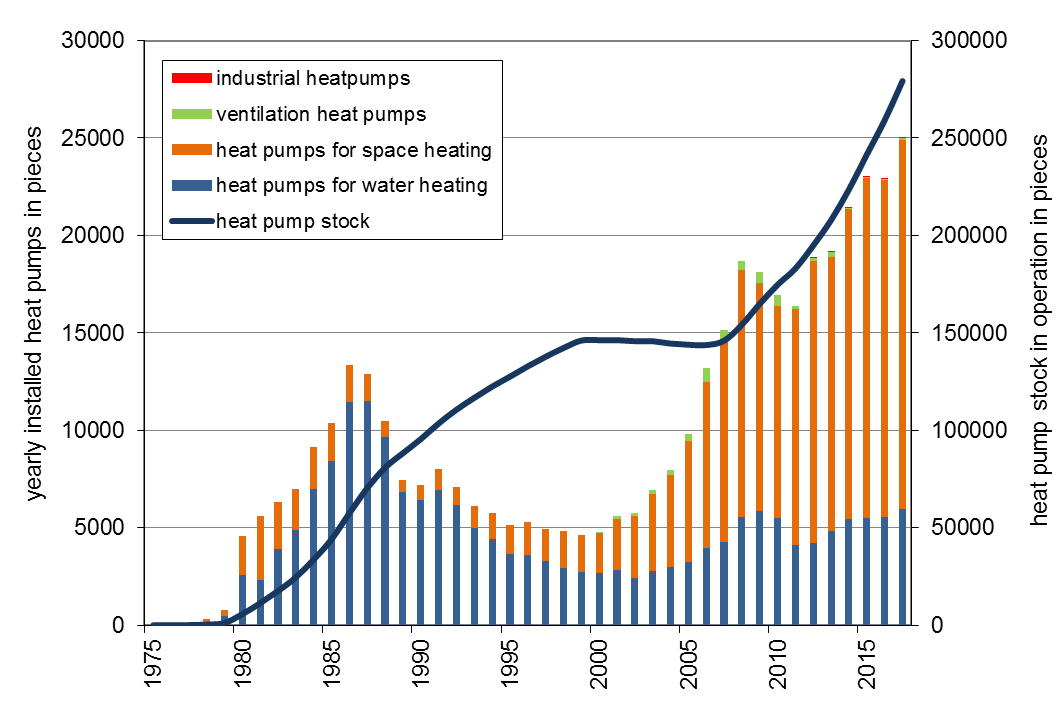

The development of the Austrian heat pump market shows an early phase of technology diffusion in the 1980's (mainly heat pumps for water heating) followed by a significant market decrease and a second increase starting from the year 2001 (now mainly heat pumps for space heating) see Figure 5.

The second diffusion period came together with the introduction of energy efficient buildings which offered good conditions for an energy efficient operation of heat pumps. This is due to the low temperature needs in the heating systems and low energy consumption for space heating.

The total sales volume of heat pumps (domestic market plus export market) increased in 2017 from 33,094 units sold in the previous year to 36,446 units. This corresponds to a growth of 10.1 %. Significant growth was observed both in the domestic market (+ 9.1 %) and in the export market (+ 12.5 %).

Strong growth was particularly noticeable in heat pumps for space heating up to 20 kW. Domestic hot water heat pumps showed an increase of 7.7 % in the home market and a decline of 8.5 % in the export market.

The percentage of the export market was 31.4 % in quantity of the total sales in 2017. In 2017 the Austrian heat pump sector (production, trade, installation and monetary value of heat) had an amount of total sales of 583 million Euro and 1,388 full time jobs. Thanks to the existing heat pump stock in Austria about 608.995 tons CO2equ of net emissions could be avoided in 2017.

Presently research and development of heat pump systems focus on innovative installations combined with other technologies: e.g. solar thermal systems for space and water heating or photovoltaic systems, new energy-services as air-conditioning, space cooling or applications in the context of renovating buildings in regard to humidity problems.

The range of innovations is completed with steady improvements of the technical energy efficiency, quality assurance measures, the use of new driving energy as natural gas and the use of the heat pump technology in smart grids.

Wind power

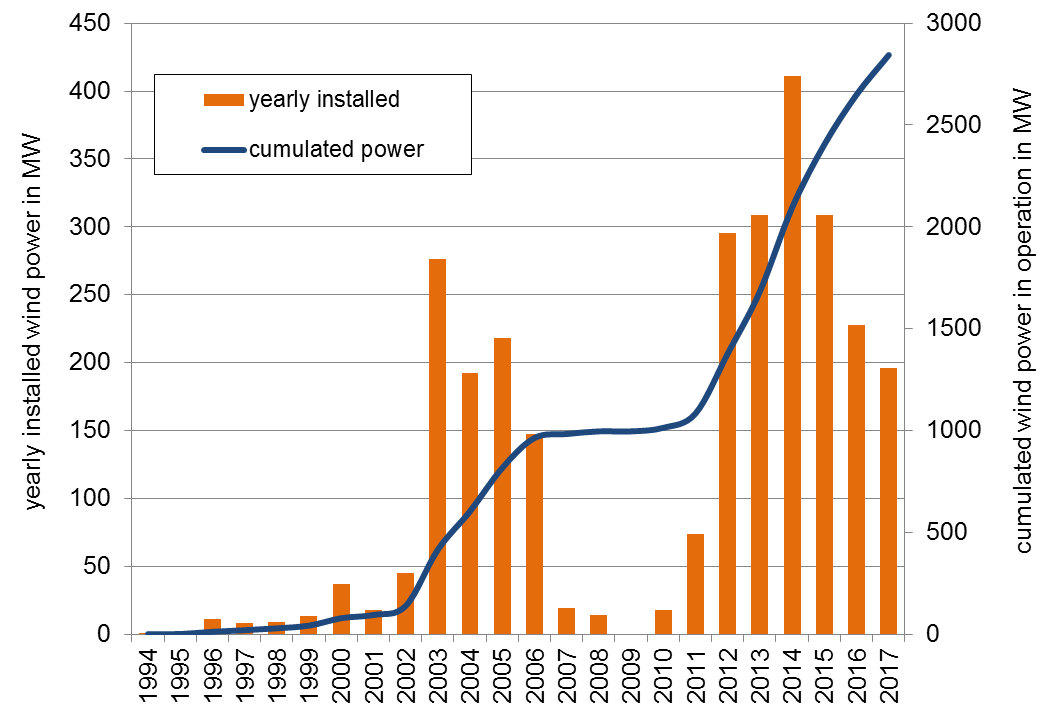

Austrian wind power has developed in different periods. The first diffusion period was based on the "Ökostromgesetz 2001" and led to 1 GWel installed wind power see Figure 6. After some years with low feed-in tariff the "Ökostromgesetz 2012" allowed to install new capacities starting with 2011 and led to a total capacity of 2,844 MWel by the end of 2017.

In 2017 63 turbines with a capacity of 196 MWel were installed. The largest part of the potential has been realized in Lower Austria (123.6 MWel), followed by Styria (59 MW), Burgenland (12.2 MW) and Carinthia (0.8 MW). In 2017 nearly 6.5 TWh electricity have been produced by wind turbines.

Compared with the stock of wind power at the end of 2016, the power generation potential increased by 19 % or 1.3 TWh. Assuming the substitution of ENTSO-E imports in 2017, more than 1.9 million tonnes of CO2eq could be saved in Austria in 2017. When substituting the fossil content of the ENTSO-E mix, the savings amount to 4.3 million tonnes of CO2eq.

In terms of technology the market of newly installed turbines in 2017 were dominated by the 3 MWel class. 62 turbines of the 3 MWel class have been installed in 2017. In 2017 Austrian turbine operators generated a turnover of more than 551 Mio. Euro. New installations of 196 MWel triggered investments of around 323 Mio. Euro and created a domestic added value of 92 Mio. Euro. The turnover of the Austrian wind industry reached nearly 454 Mio. Euro in 2017. In total the wind power sector had a turnover of 1.005 Million Euro.

Based on the feedback of the questionnaires 1,330 persons were employed in the industry sector. 372 persons were employed by turbine operators. Considering the effects elaborated in the study „Wirtschaftsfaktor Windenergie", around 3,074 jobs come from turbine installation, operation and dismantling. In total the aggregated employment rate lies at 4,404 jobs (adjusted for duplications).

Conclusions

In 2017 the market development of the investigated technologies was characterized by a mixed appearance. The biomass fuel, biomass boilers, photovoltaic and heat pump sectors showed significant growth, while the biomass furnaces, solar thermal and wind power sectors showed declining sales and new installations respectively. Thus the overall result is better than in 2016, but achieving the medium to long-term energy and climate goals requires much more ambitious development.

On the one hand, in 2017 groth was at a low level at least for biomass boilers and the increase in biomass fuels was largely weather-related. On the other hand, in view of the already massively reduced market and the reduced production, a rapid turnaround in the area of solar thermal energy has become very unlikely and a substitution of the lack of solar heat by photovoltaic cannot be seen at the moment.

The important influencing factors in 2017 were:

- Continuously low prices for fossil fuels: the decrease of the raw oil price started in autumn 2014 and caused a rapid price decline below 60 $/barrel and from autumn 2015 even below 40 $/barrel and the decrease continued in 2017. Meanwhile the price for oil and natural gas can be marked continuously low. This circumstance has a strong influence on the structure of the boiler market and is equally effective in the sector of new buildings as well as renovations and exchange of boilers.

- The price of solid biomass has risen gradually in recent years, reaching the real specific price of 2006 in the pellets sector in the winter of 2013/14, which had already led to the slump in pellet boiler sales in 2007. Decreases in the pellet price after the heating season of the following years were unable to compensate for the psychological effect of the high prices in 2013/2014, whereby this effect was increased above all by the simultaneously longer-term low oil price. In fact, energy in the form of heating oil in January 2016 was almost as expensive for consumers as energy in the form of wood pellets, with a visible price difference again in 2017.

- In the years after the financial and economic crisis 2008 an increase of early investments of private households in real long-life systems could be observed. This was due to the uncertainties in regard to the currency stability and due to the generally low level of interest rates. Especially photovoltaics and biomass boilers but also the area of heat pumps benefited from that temporarely. In the mean time this potential is used up and the earlier investments are missing in the actual sales figures.

- In the past years a growing competition among some technologies for the use of renewable energies developed. In particular a competition between solarthermics and photovoltaics could be observed but also between biomass heating systems and heat pump systems. For one thing this is due to various economic learning curves of the technologies, various subsidies and it is also due to external factors such as the development of the oil price or the structural development of the existing building stock.

From the presented results of the work the following target group-specific recommend-dations can be derived:

Energy policy makers are confronted with the challenge of using the limited public subsidies for efficient and longterm effective instruments which are incentive oriented. Apart from the appropriate amount and the dynamic use over a period of time continuity is also an important factor in this area. The economy also needs continuity and predictability more than great onetime effects.

Innovative methods of optimally using the subsidies as for example weekly Internet auctions enable a good use of the private willingness to pay and improve the efficiency of the subsidies as for example free riders are reduced. On the contrary longterm static (excessive) subsidies are just as bad for the diffusion of technologies as stop-and-go subsidies. Furthermore a budget neutral financing of incentive oriented energy political instruments through a CO2-tax would mean double efficiency at reaching the goal one was aiming at.

Anyway the use of normative instruments in the area of energy efficiency or in the area of technological designs (for example standards for exhaust fumes) is efficient and also effective when it comes to testing the rules. Normative instruments have hardly proved themselves as an incentive on the market (for example enacting a technology). Due to the practically necessary simple wording the instrument is suboptimal, normally far too rigid to keep track of technological advances (also concerning alternative solutions) and politically hardly possible to maintain on the long term.

Regularly updated technology roadmaps and long-term monitoring of actual developments are essential as a basis for the development of efficient and effective energy policy instruments. Only in this way target paths can be defined, controlled and readjusted with the help of energy policy measures in order to achieve the medium- to long-term national energy and climate goals safely.

The technology producers of the examined sectors can be recommended from the current developments, on the one hand by constant innovation efforts to obtain competitive products and to develop new markets or applications. Equally important, however, is the dissemination of economic learning effects to the end customer in order to create long-term competitiveness.

A standstill of development goes hand in hand with a decrease of innovation advantage and competitive advantage. In this context, the observation and analysis of the retail market is of great importance. The characteristics of the technology must match the current status of the innovation diffusion process in terms of complexity, design and retail price, as it can quickly come to a standstill in the absence of dynamic and adapted technology development and pricing.

Concluding interesting topics in research and development are found in the areas which lead to system innovations.

Examples are: the development of "plug and play" solar thermal systems with competitive prices for the consumer, the development of heat storage installations with high heat density and/or seasonal heat capacity, the development of solutions for the integration of electricity and heat into buildings, the development of plus-energy houses and many more. Additionally optimizing energy policy instruments is an important challenge.

Downloads

- Final report (German) (pdf, 13.61 MB)

- Summary (English) (pdf, 1.55 MB)

- Presentation (English) (pdf, 788.27 kB)